The first integrated

self-employment platform

The first integrated self-employment platform

One platform to run your modern business of one. Besolo is your self-employment operating system, consolidating all the tools needed to be a solopreneur while unlocking benefits access.

See it for yourself

The all-in-one platform for independent professionals

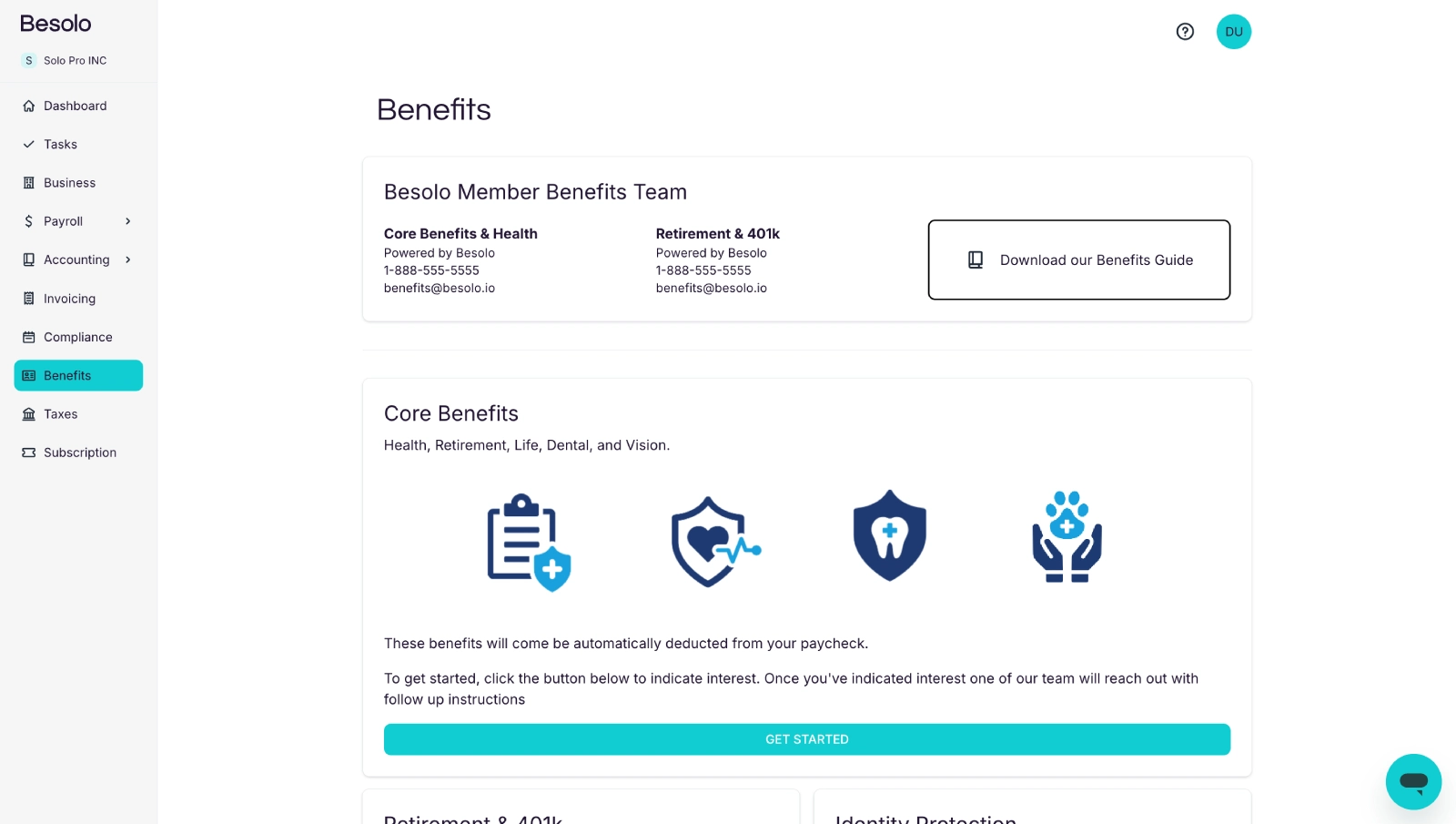

Benefits access

Solo 401K included for all members. Revolutionary access to benefits options for S Corp members including PPO healthcare, dental, life & more.

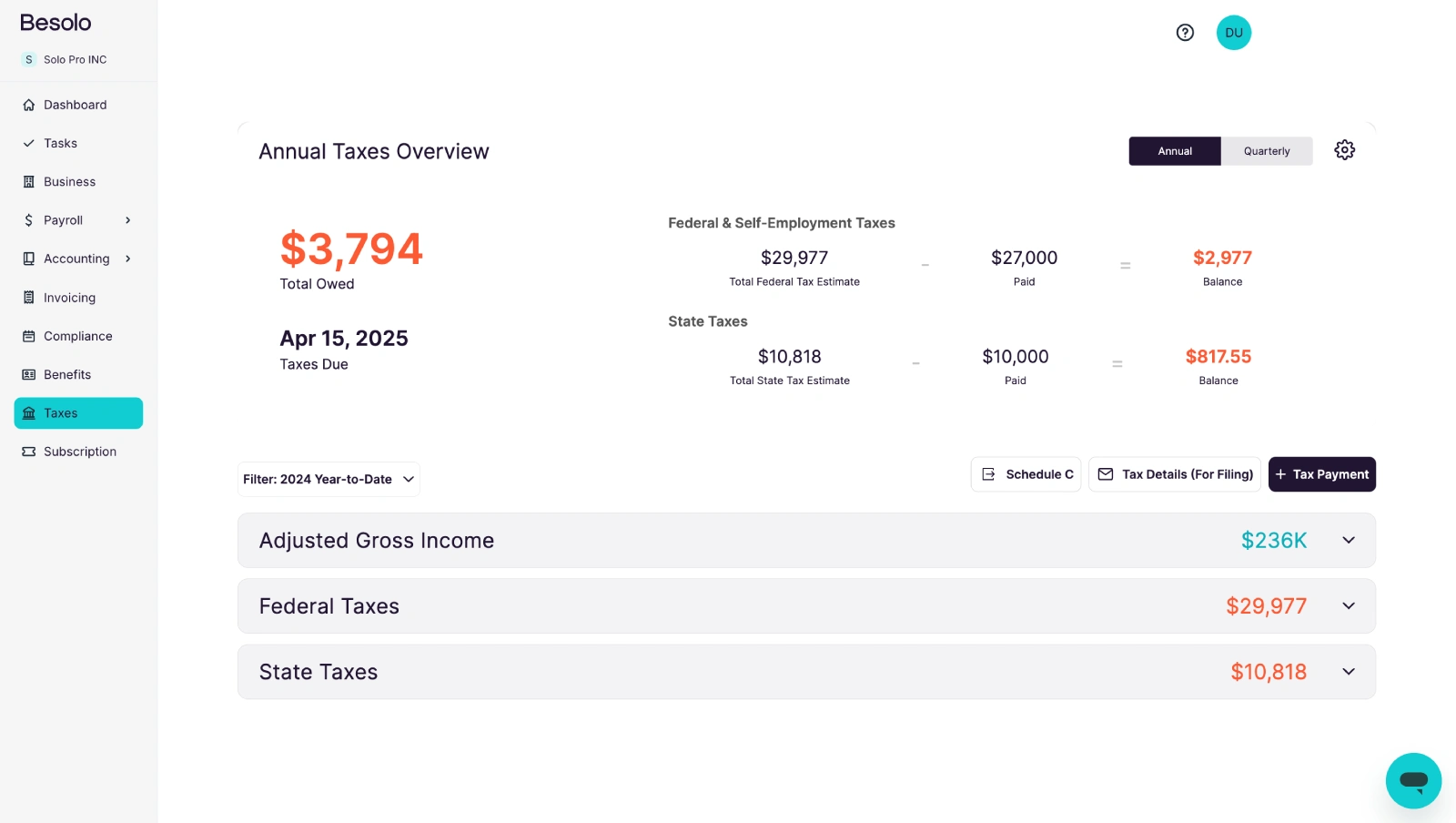

Tax system

A complete tax system built for businesses-of-one. Choose LLC or S Corp depending on your goals, Besolo makes taxes easy.

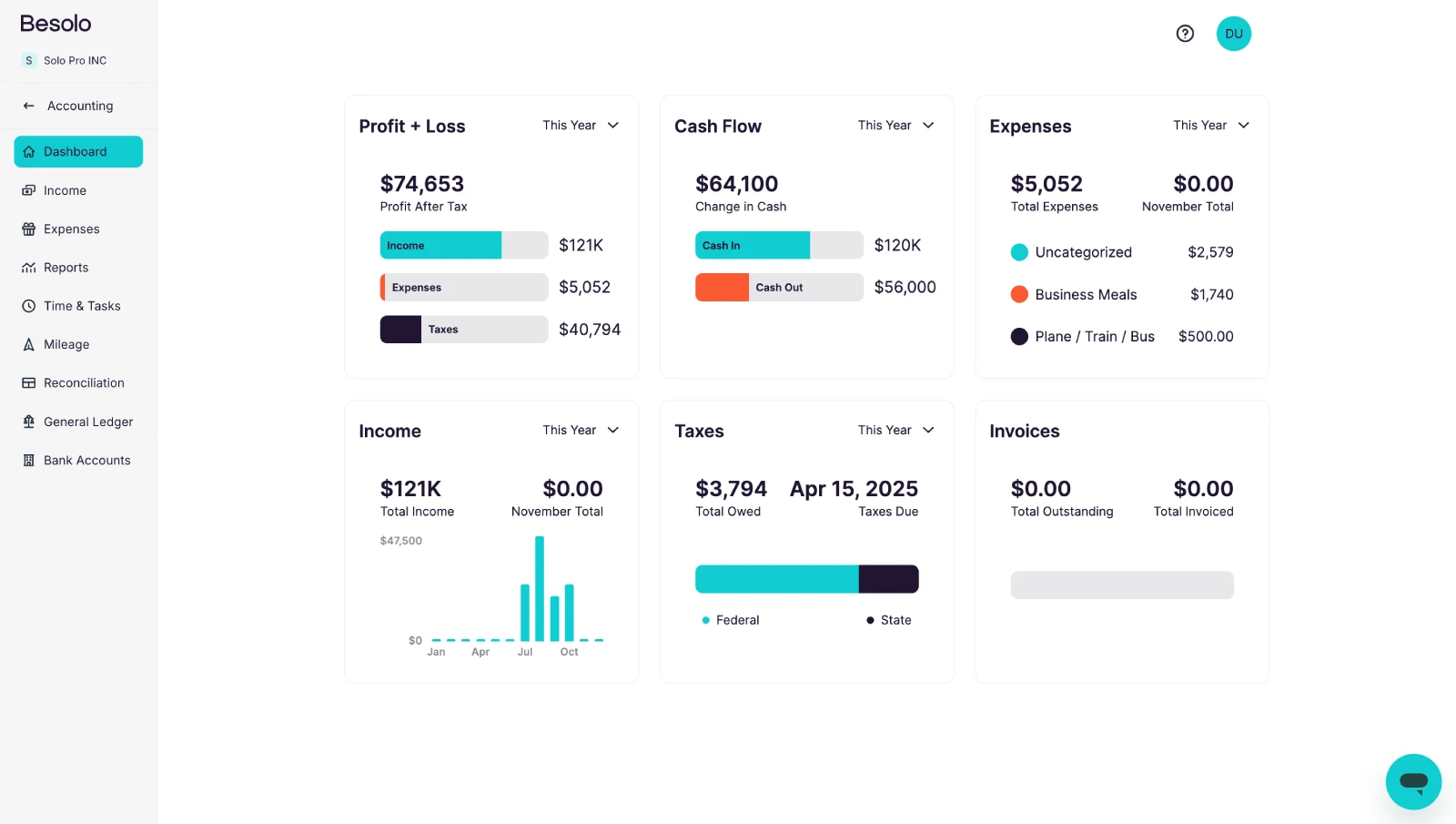

Admin

Cover the most painful company admin tasks in one place with one support team. Company compliance, accounting, time tracking & invoicing.

Benefits access

Besolo gives unparralled benefits access to both LLC and S Corp members. We’ve done the hard work of picking what is best for solos and making them easy to turn on as needed.

Choose your path

Tax system

Taxes are one of the most intimidating parts of being a self-employed solo. Besolo makes quarterly estimated and annual taxes easy with licensed tax pros who are all USA-based.

Choose your path

Admin & compliance

Whether its accounting, invoicing or state/federal compliance, Besolo helps handle all the mundane parts of being a solo.

Choose your path

Multiple ways to run your solo business

It’s not one size fits all and can evolve over time. With the Besolo platform you have options and room to grow or shift as your business does.

Solo

LLC

Legal protection, flexibility, low maintenance

For solos & side hustlers who want protection with flexbility

Solo

S Corp

Everything that an LLC gives + tax savings

Great for seasoned full-time solos with larger annual income

Multiple ways to

run your solo business

It’s not one size fits all and can evolve over time. With the Besolo platform you have options and room to grow or shift as your business does.

Solo

LLC

Legal protection, flexibility, low maintenance

Solo

S Corp

Everything that an LLC gives + tax savings

For solos & side hustlers who want protection with flexbility

Great for seasoned full-time solos with larger annual income

LLC or S Corp – which is right for you?

We’re here to help you navigate the differences between LLC and S Corp. We’ll also let you know how that changes what Besolo can do for you.

Core Besolo features

Included for all Solo LLC & S Corp members, the first all-in-one platform on the market

Solo S Corp features

Included for all Solo LLC & S Corp members, the first all-in-one platform on the market

Latest posts on the Besolo blog

Washington State Sole Proprietorship vs LLC vs S Corp

If you’re working full-time but exploring switching to fractional work or entrepreneurship, choosing a business structure is a critical first…

Texas Sole Proprietorship vs LLC vs S Corp

For Texans eager to leave the nine-to-five grind, choosing the right business structure is pivotal. Many new solopreneurs begin as…

California Sole Proprietorship vs LLC vs S Corp

Breaking free from the nine-to-five grind and building something of your own in California is an exciting step — but…

Examples of Sole Proprietorship That Will Inspire You

Have you ever considered leaving the nine-to-five routine to take charge of your career? Many professionals who have dabbled in…

When Does It Make Sense to Change Sole Proprietorship to LLC

Selecting the right business structure directly impacts liability protection, tax flexibility, and long-term growth. A sole proprietorship is the simplest…

Choosing Business Insurance for Your Sole Proprietorship

Running a business as a sole proprietor comes with financial risks. Unlike incorporated businesses, like LLCs or S Corps, sole…

Mastering Time Tracking and Invoicing for Freelancers

Transitioning from a steady job to freelancing is a common aspiration for many who have tried consulting or side gigs.…

How to Invoice as a Freelancer Quickly and Efficiently

Freelancers rely on invoicing to get paid, maintain cash flow, and keep their business running smoothly. Unlike traditional employees who…

Best Invoicing Software for Freelancers Who Want to Save Time

Making the shift from a full-time job to freelancing is a big step, especially when it comes to managing finances.…

Fractional Jobs That Are Easy to Transition into from W2

With advancements in technology — such as the dramatic way that artificial intelligence is changing business strategies — and tighter…