Benefits — healthcare, 401K, pet insurance & more

Value

Solo S Corp empowers revolutionary access to a complete benefits package for independent professionals.

Healthcare

PPO medical plan options, dental & vision

Solo 401K

Payroll integrated solo 401K with $69K limit

Life, pet & more

Complete lifestyle & family protection options

Options

National PPO healthcare

Solo S Corp gives you access to ACA compliant, major medical national PPO healthcare with four different plans to match the needs of your household. Licensed agents are available to help assess which plan is best for you and your family.

Dental, vision, life, accident insurance

Besolo’s benefit’s options don’t stop at healthcare, we have competitive options for the most commonly requested types of protection individuals & families need. We’ve done the hard work of negotiating the best rates, you just get to choose what you need.

Solo 401K

87% of independent professionals do not participate in any form of formal retirement plan. Missing out on the tax benefits of 401K is a big miss for the sustainability of an independent lifestyle.

Pet insurance

Fur babies need protection too, but sadly many of the plans available on the open market are overpriced for poor coverage. Besolo gives you access to a $25K/90% reimbursable/$250 deductible pet insurance plan at the best price possbile.

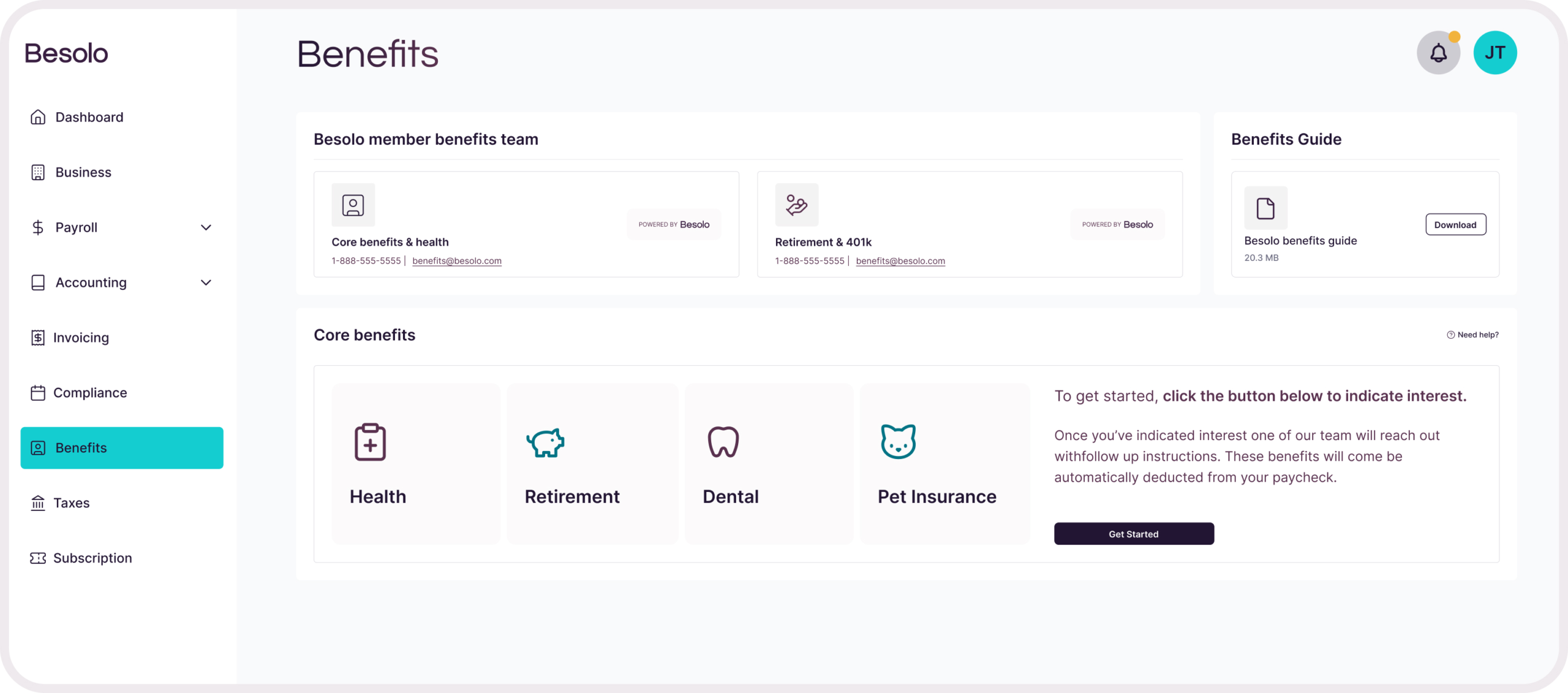

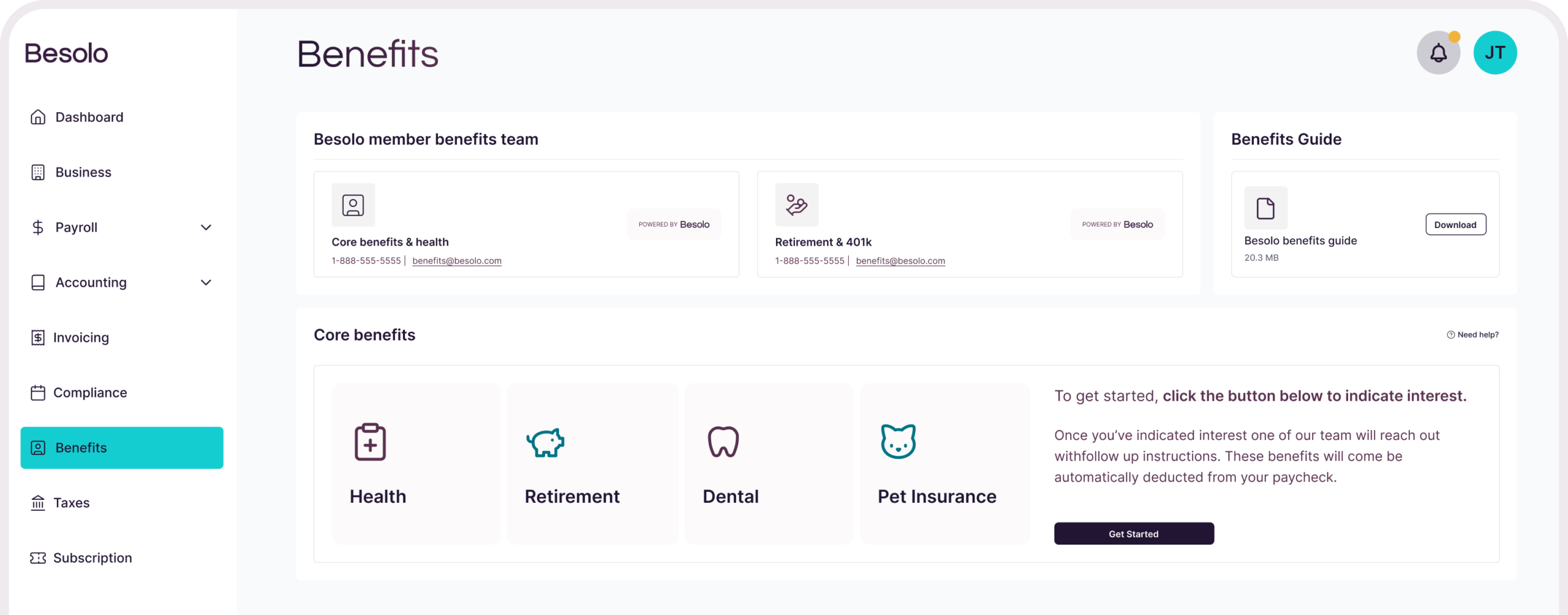

Deducted from your S-Corp payroll

Benefits you elect get funded right from the payroll you run for yourself through the Besolo platform. This makes ongoing admin and tax time much easier.

Pricing

$349/month for Besolo S Corp support

One platform for all things business-of-one

Access to PPO healthcare options

Payroll integrated solo 401K

Complete S-Corp support for massive tax savings

Access to other benefits like life, dental, pet, accident & vision insurance

Business & personal tax filings from licensed tax professionals

Accounting, time tracking, invoicing & bookkeeping support

Holistic company formation, compliance & operations system

FAQ

Everything you need to know about Self-Employment OS

What is co-employment?

Co-employment is a business practice that has existed for decades. A third-party company like Besolo handles client companies’ payroll, HR, and benefits administration. Group benefits options are unlocked by pooling all the client employees together under one federal EIN.

Besolo and all companies that do this are called professional employer organizations or “PEOs” for short.

Historically, it was reserved for companies with ten or more employees because of service-driven inefficiency. Thanks to the technology in the Besolo platform, the inefficiencies are gone. This is how we can offer co-employment to companies of one.

Why do I have to run payroll?

Running a payroll for yourself unlocks two amazing values. First is the ability to see large tax savings via S Corp, second is that it is a major piece in unlocking benefits through Besolo. The benefits we offer, including the 401K, automatically deduct from payroll for additional administrative convenience.

Are the benefits included in the monthly fee?

Access to the solo 401K is included in the monthly Besolo fee (compared to $40-50/month from other providers). There is still a standard 401K management fee, but it is a class leading 50 basis points (0.5% per year) charged by the 401K administrator.

All other Besolo benefits are electable and have an associated cost if you choose to use them. The Besolo team negotiates group rates with benefits providers so you can see savings and/or better coverages compared to many open marketing options.

Can I hire employees for my company with Besolo?

You can have as many contract workers for your company as needed, you just cannot hire additional W2 employees. Part of how we unlock group benefits for you as a solopreneur means that we only work with businesses that have one W2 employee (you). Many solopreneurs we work with actually find contract team members tend to be a better fit for their needs anyway.