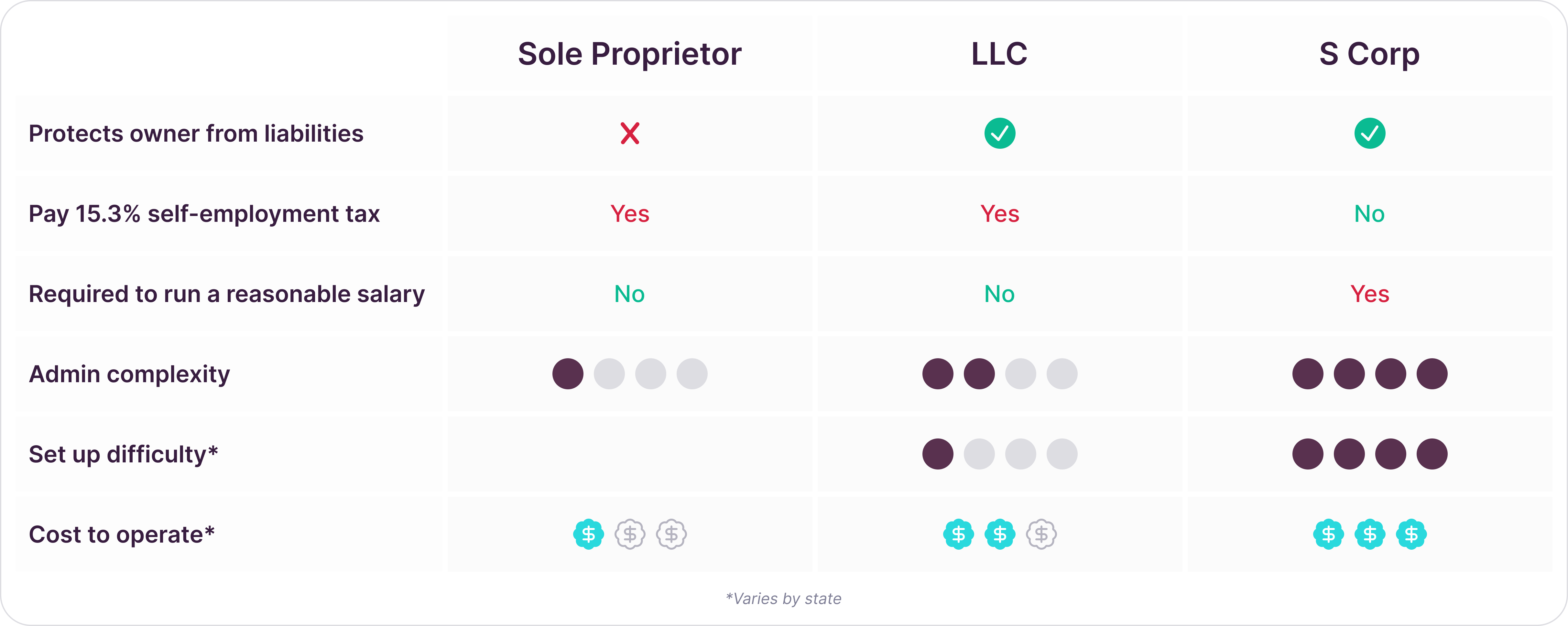

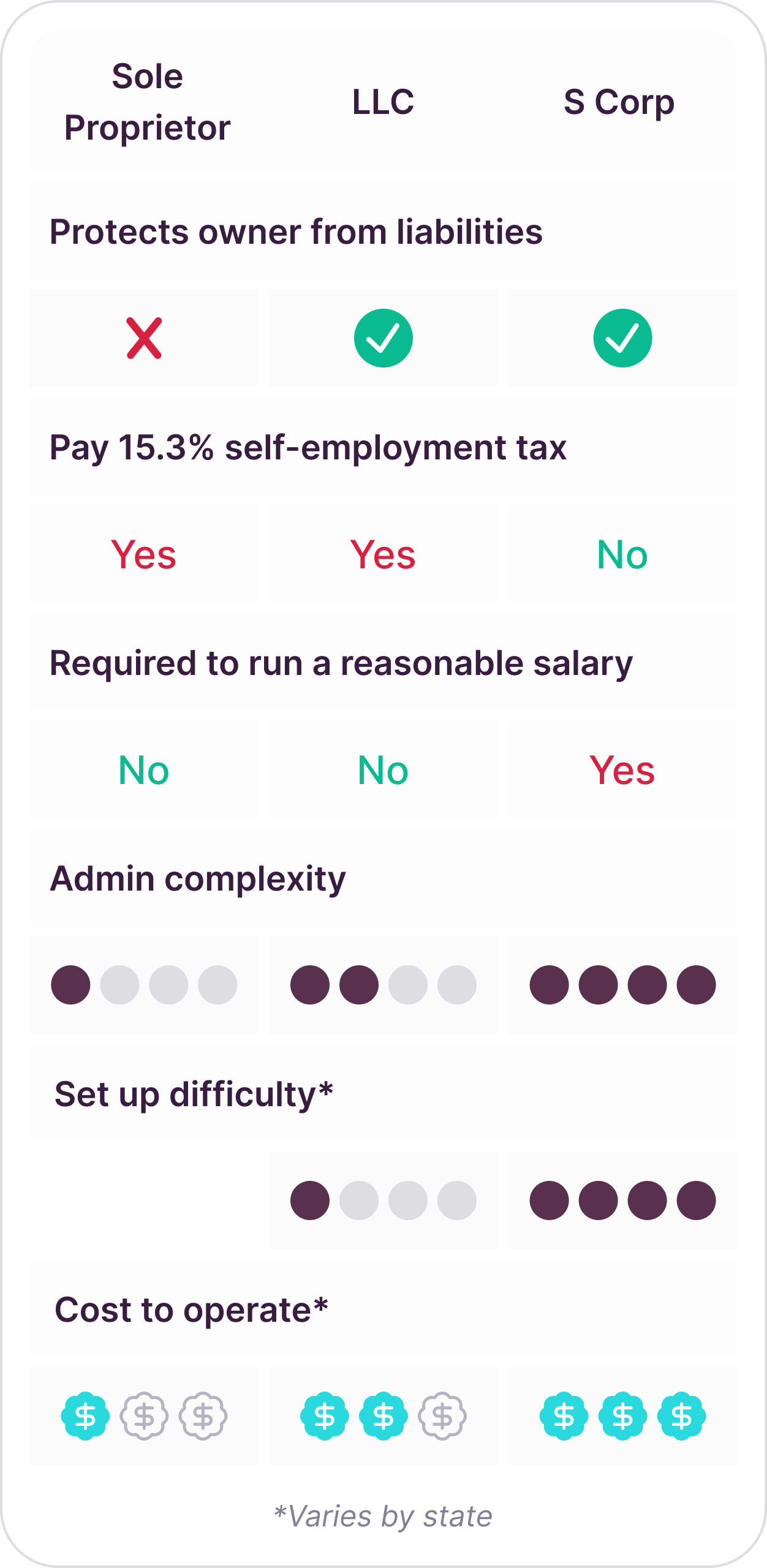

LLC vs S Corp

We firmly believe that every business of one should have at least an LLC to protect personal assets. From there the choice between LLC & S Corp gets more complicated.

Learn the pros and cons here, these assume you are operating as a business of one (no additional owners/employees).

LLC

- Value

- Legal protections of a company with similar operations to a sole proprietor

- Maximum flexibility for lifestyle, no reasonable salary requirements and no board of directors required

- Legal/taxes

- Protect your personal assets as an owner, you contract as a business

- Passthrough taxation just like being a sole proprietor - Schedule C of 1040

- You can use a solo 401K to shield pre-tax dollars

- sDownsides

- More compliance filings and fees than being a sole proprietor, but typically only once a year

- Must be formally dissolved if you want to stop doing business

S Corp

- Value

- Same legal liability protections as LLC

- Empowers additional tax savings (3-6%) through the use of a reasonable salary (W2 payroll) for yourself as the owner/employee

- Legal/taxes

- You have to run a W2 payroll for yourself to see the tax savings

- Must have separation of business & personal finances

- You can use a solo 401K to shield pre-tax dollars via payroll

- sDownsides

- You should consistentlaly be making at least $80-100K net business income, otherwise costs can trump savings

- Payroll & accountable plan adds burden that can impede on flexibility

- More compliance filings than an LLC + an additional Federal tax filing (1120s)

Choosing the correct business structure

Selecting the right business structure is crucial for legal protection, tax benefits, ease of operation, and flexibility. Each option offers unique advantages:

Start as an LLC today level up to S Corp later

With Besolo, you don’t have to choose between one or the other. Start as an LLC to enjoy all the value of our platform. We’ll guide you if/when transitioning to an S Corp is the right move for your business.

Solo

LLC

Legal protection, flexibility, low maintenance

For solos & side hustlers who want protection with flexbility

Solo

S Corp

Everything that an LLC gives + tax savings

Great for seasoned full-time solos with larger annual income

Start as an LLC today

level up to S Corp later

With Besolo, you don’t have to choose between one or the other. Start as an LLC to enjoy all the value of our platform. We’ll guide you if/when transitioning to an S Corp is the right move for your business.

Solo

LLC

Legal protection, flexibility, low maintenance

Solo

S Corp

Everything that an LLC gives + tax savings

For solos & side hustlers who want protection with flexbility

Great for seasoned full-time solos with larger annual income

Core Besolo features

Included for all Solo LLC & S Corp members, the first all-in-one platform on the market

Company Formation

Compliance System

Time Tracking & Invoicing

Accounting

Quarterly Tax Estimates

CPA Consultations

Tax Filing - Personal & Business

Solo 401K

Additional Benefits Options

Solo S Corp features

Included for all Solo LLC & S Corp members, the first all-in-one platform on the market

S Corp Election

Solo W2 Payroll

Accountable Plan

CPA Consultations

Quarterly Tax Estimates

S Corp Tax Filing

Personal Tax Filing

Compliance Calendar

Complete Benefits Package

PEO